During business team meetings to discuss increasing growth and earnings, how often have you heard someone suggest doing a market research study? Often, a specific type of survey is suggested—maybe a conjoint or a segmentation, or a satisfaction study. The scope of the study would be consistent with the specific area of discussion—product-oriented, positioning and communications-related, or even route-to-market issues. However, usually, a pricing study is suggested. After all, an increase in price goes directly to the company’s bottom line.

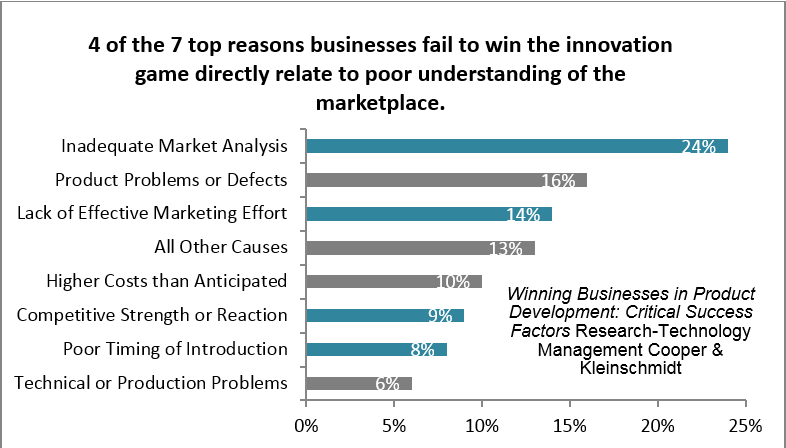

By doing the study, the team may gain valuable information on the impact of a potential change, but they also may be blindsided by thinking that the market variables they are evaluating are independent of other market variables. For example, doing a pricing study alone does not take into consideration the impact of product design, competitive positioning, customer segments, promotional channels, and other key elements of the marketing strategy. It also does not provide the team with the correlations, or relationships, between all of the marketing elements. They miss the underlying market drivers that define the market characteristics they must address to grow the business. More importantly, it may not effectively address the competition’s reaction to a change in any one or all of the marketing variables.

What you really need is market analytics—the capture of all of the relevant market data that has been integrated, analyzed, and interpreted specifically to completely evaluate all of your options for growth. Market analytics not only recognizes the interdependence of the four Ps of marketing (product, promotion, price, and place), but also models that interdependence in a way that enables you to consider multiple options and the associate risk.

An effective market analytics effort requires the market team to do the following:

Know what you need

This step is often taken for granted, given the team’s ongoing discussions; however, it is critical to understand what the analytics is to be used for to identify what is needed. Based on “what it takes to win,” develop strategy options and challenges that need to be addressed1. From this work, the team can easily describe what they need to know to transform hypothesis into market strategy.

Here, it is best to start with a blank slate. With the strategic objectives in mind, a list of key issues needs to be addressed. These include competitive positioning, importance of factors, key outcomes, pricing, customer attitudes, and issues. Some of the elements of these should already be known, but some may still be hidden.

- Think outcomes, or what the specifiers in the market may want to happen as a result of an interaction with you. They buy products and services to help them get their jobs done.

- Do a qualitative market assessment to identify the hidden elements and validate that the list of potential outcomes is correct. The key here is to discover what specifiers value and the criteria they use to measure supplier performance.

- Design your quantitative market study in a way that can both measure the market and test concepts. A good quantitative design employs exercises in which the respondent is asked to choose what is important to them, and identifies the difficulty a respondent is having in achieving their most desired outcomes. The design should capture the respondents’ beliefs and attitudes about the primary topic, competitive behavior, and willingness to act as desired.

A well-designed market analytics study should provide you with the information to prescribe your actions for success2. Using causal data in a concept test or pricing exercise lets you learn what will motivate the market to respond in a specific way. Market analytics causes the team to take action: If you do this, then you will get that.

Without providing actionable implications, market analytics is almost useless. One company complained so much about the quality of their quantitative market research that they stopped conducting surveys altogether. In their words, “Nothing was actionable.” But they needed insight into the market. So, they took a different approach. Building on qualitative learnings, they designed and executed a market analytics study. The shift from market research to Market Analytics delivered intelligence. It became the compass pointer to the actions that would deliver the product their customers would pay for.

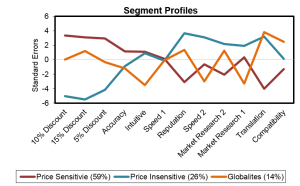

The market consists of different groups of customers, or segments. These segments can be defined by their differences in attitudes, price sensitivity, and benefits they derive from product features, and then further sliced by key market drivers, such as outcome performance, attitudes, feature benefits, and even key demographic and sales factors. By segmenting by behavioral factors like price sensitivity, you can both identify multiple value propositions and select target groups that best fit your capability to deliver value. Analysis by segment also tells you how you fare against competition within each group.

In one example, a company found that with two of three identified segments, they could deliver distinctive value propositions to each segment better than their competitors could. They then found a way to engage each segment, uniquely modifying all elements of their marketing mix, including pricing selectively to each, as well as pricing differently than to the non-targeted segments.

Effective market analytics generates the insights to build alternate strategies. Your team should have some hypotheses about alternatives before embarking on a market analytics study. Those alternatives should be tested in the qualitative phase, then incorporated into the quantitative study design. By compiling the learnings and gaining the multiple perceptions, you can generate analytics on each alternative and conduct risk assessments.

In one example, a company found a potential new opportunity, a Blue Ocean3, that was beyond the original scope of their market analytics. They went back to the marketplace to test the resulting value proposition with potential early adopters for a new strategy. The outcome that drove them to reevaluate was “We want our supplier to ‘take charge’ of the whole transaction.” They were originally reluctant to include that outcome. But once it was explored further, they were able to validate the outcome and create a value proposition that they could deliver against. This increased their bottom line through economy of scale.

A market analytics study incorporates a comprehensive assessment and analysis of the critical components of how your business interacts within a defined market. Obviously, the study design is dependent upon the nature of your market and competitive environment. However, for most business-to-business markets, the market analytics study answers most or all of these questions4:

- How important are our product attributes to the market, and how do the major competitors (including us) perform against those attributes?

- What benefits (outcomes) do the specifying customers in the market want to achieve and how do they perceive their primary suppliers performing relative to those outcomes?

- What new features would provide us with a Blue Ocean5 of opportunity?

- How can we distinguish between what customers say is important versus how they actually behave?

- How do these attributes and outcomes vary by different segments of the market, or what segments are derived from different responses to attribute and outcome importance?

- How will price changes impact competitive share, and how does that differ among the defined segments based on attribute and outcome importance?

- What is the right balance between price and share that maximizes our profits?

- How would customers value a new product concept that we are considering bringing to the market, and what would they be willing to pay for the concept?

- How would customers value some new offering features we may bring to the market, and how does that value differ across the customers?

- How do customers perceive our brand versus competitive brands6?

- What are the underlying structural components and attitudes of the market which define where we need to focus for future growth?

With these answers, you are ready to succeed with your product launch.

1We use an interesting method called “Future Business History™,” where the team identifies a hypothesis future state and then creates a history (key events) that led them there, and then defines the challenges they need to address.

2Key statistical methods such as correlations, regressions, factor analysis, and clustering can very useful here.

3Blue Ocean Strategy

4Breakthrough Toolkit™

5Blue Ocean Strategy: How to Create Uncontested Market Space and Make Competition Irrelevant by W. Chan Kim & Renee Mauborgne

6Brand Attributes Perception

Ron Sullivan

Ron Sullivan is a Senior Partner at Breakthrough Marketing Technology. His past experience working with global companies in Europe and Asia and across the U.S positions him as an invaluable resource at the front line of business growth. He has worked with clients on innovation, new product development processes, strategy, building new business models, channels, and pricing optimization. He is skilled at leading executive level initiatives across all aspects of your business.